Seasonal Stock Rally

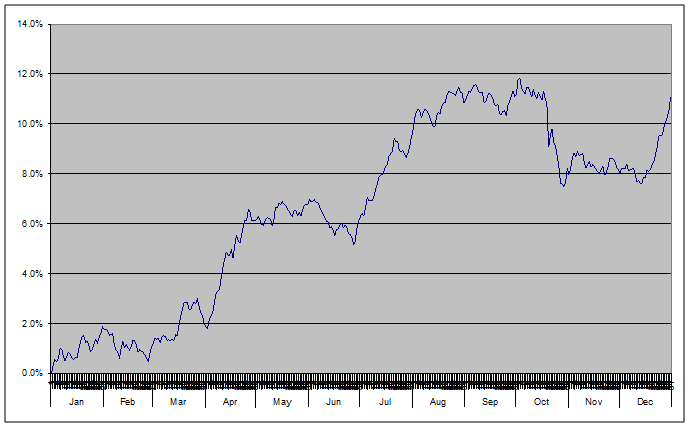

Over the past 100 years, U.S. stocks tend to dip in mid-December after rising earlier in the month. After the dip, they bounce back by year-end. They then keep rising in January. This has happened most of the time over the last 10, 20, 50, and 100 years. Whether you are looking at the past 100, 50, or 20 years, the average gain for December has been just under 1.5%. December has been a positive month in 73 of the past 100 years (64 of the last 100 years for January).

If stocks are not rising at the end of December and are not rising at the start of January, something is usually wrong with the stock market. If stocks do not do well in the first two weeks of January, it is usually a bearish indicator for the rest of the year. Over the past 20 years, April, October, and November were, on average, stronger months than December. Over the last 20 years, the worst three months for U.S. stocks have been June, August, and September (each month having an average loss of < 1%). Over the past 100 years, the worst month (by a wide margin) has been September, with an average loss of < 1% for the month.